Zillow Dallas offers a comprehensive view of the dynamic Dallas real estate market. This platform provides invaluable resources for both buyers and sellers navigating the complexities of the local housing landscape, from understanding neighborhood trends and price ranges to identifying potential investment opportunities. We will explore how Zillow’s data can inform decisions about purchasing, selling, or investing in Dallas properties.

This exploration will delve into the current market conditions, analyzing key factors influencing property values across various Dallas neighborhoods. We’ll compare Zillow’s data with other real estate sites, highlighting its strengths and limitations in the context of the Dallas market. The analysis will also encompass different property types, price ranges, and investment strategies, offering a holistic perspective on utilizing Zillow for navigating the Dallas real estate scene.

Dallas Real Estate Market Overview

The Dallas real estate market is currently experiencing dynamic shifts, influenced by a complex interplay of economic factors, demographic trends, and infrastructural developments. Understanding these influences is crucial for both buyers and sellers navigating this competitive landscape.

Current Market Conditions in Dallas

Dallas exhibits a robust real estate market characterized by strong demand and relatively low inventory. This combination typically leads to competitive bidding situations and price appreciation. While the pace of growth might fluctuate, the overall trend indicates a consistently active market. Factors such as population influx and a strong local economy contribute significantly to this sustained activity.

Factors Influencing Property Values

Several key factors contribute to the valuation of properties in Dallas. These include location, proximity to employment centers, quality of schools, neighborhood amenities (parks, shopping, dining), property size and condition, and overall market demand. The presence of new construction and planned developments also influences prices in specific areas.

Neighborhood Market Trends

Dallas boasts a diverse range of neighborhoods, each with its unique market characteristics. Upscale areas like Highland Park and University Park consistently command premium prices, reflecting their established prestige and desirable features. Meanwhile, neighborhoods undergoing revitalization or offering more affordable options, such as East Dallas or Oak Cliff, present different investment opportunities and price points. These varying trends reflect the diverse nature of the Dallas real estate market.

Average Home Prices Across Dallas Neighborhoods

| Neighborhood | Average Price | Median Price | Price per Square Foot |

|---|---|---|---|

| Highland Park | $2,500,000 | $2,000,000 | $600 |

| University Park | $1,800,000 | $1,500,000 | $500 |

| Preston Hollow | $1,500,000 | $1,200,000 | $450 |

| Lakewood | $800,000 | $700,000 | $300 |

Zillow’s Role in the Dallas Market: Zillow Dallas

Zillow has become an integral part of the Dallas real estate landscape, significantly impacting how people search for and evaluate properties. Its comprehensive data and user-friendly interface have reshaped the home-buying and selling process.

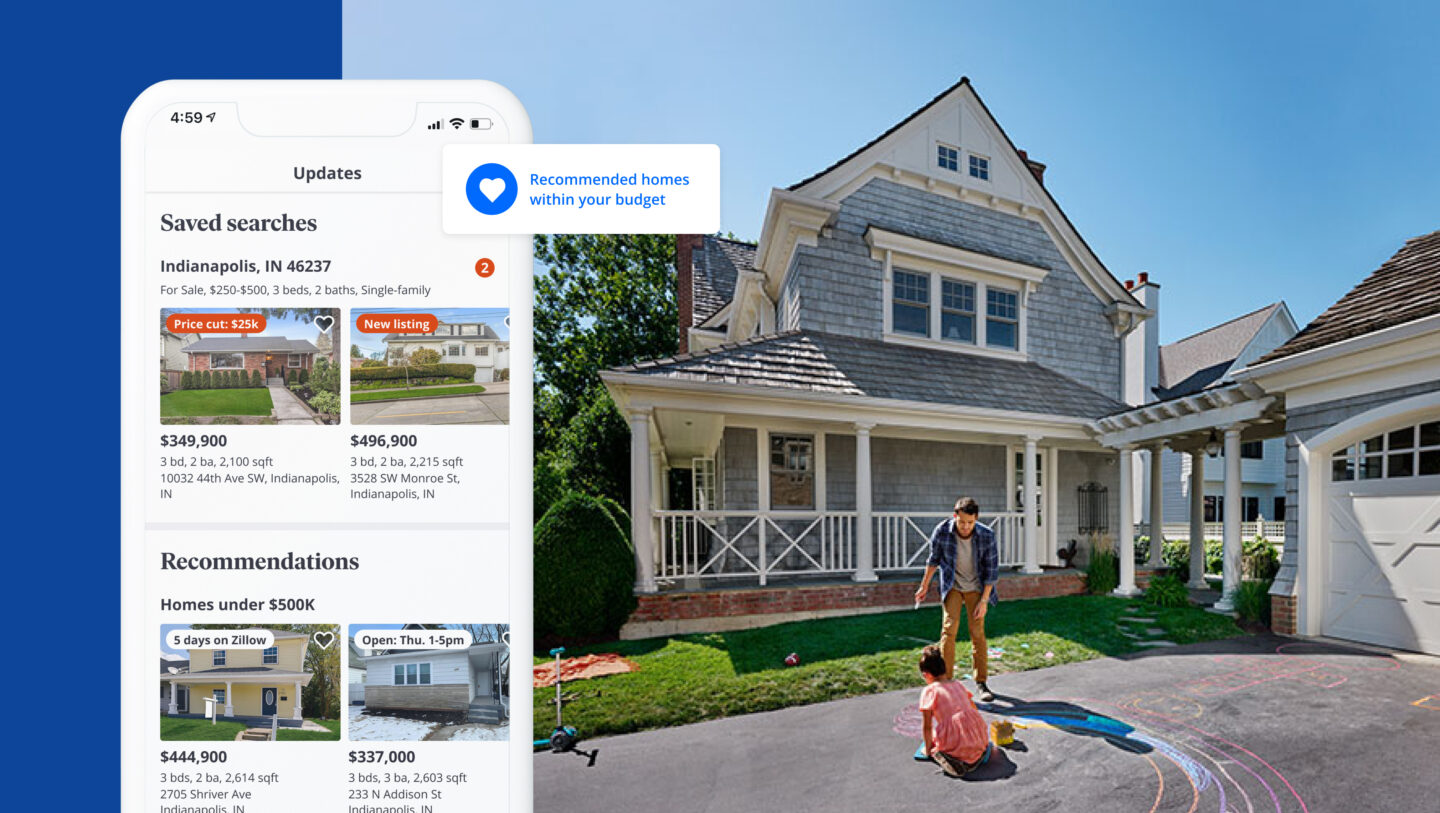

Zillow’s Impact on Home Searches

Zillow provides a centralized platform for accessing a vast amount of real estate data, allowing potential buyers to easily browse listings, compare properties, and research neighborhoods. Its detailed property information, including photos, virtual tours, and neighborhood insights, enhances the overall search experience and empowers consumers to make informed decisions.

Useful Zillow Features for Dallas Homebuyers and Sellers

Zillow’s features most beneficial to Dallas residents include its robust search filters, allowing users to refine their searches based on specific criteria (price, location, property type, etc.). Zestimate, while not always perfectly accurate, provides a valuable benchmark for property valuation. The ability to save searches and receive alerts for new listings is also highly useful.

Browse the implementation of craigslist atlanta in real-world situations to understand its applications.

Comparison with Other Listing Sites

While Zillow is a dominant player, it’s important to note that other real estate listing sites, such as Realtor.com and Redfin, also operate in the Dallas market. Each platform offers slightly different features and data sets, and users may find that one platform is better suited to their specific needs. However, Zillow’s extensive reach and user-friendly interface make it a popular choice among many.

Typical Zillow User Persona in Dallas

A typical Zillow user in Dallas might be a young professional, a family relocating to the area, or an investor seeking opportunities in the Dallas market. They are likely tech-savvy, value convenience, and prioritize access to comprehensive and up-to-date information. They use Zillow as a primary resource for their initial research and property exploration before engaging with real estate agents.

Property Types and Price Ranges in Dallas

The Dallas real estate market encompasses a wide variety of property types and price points, catering to diverse preferences and budgets. Understanding this diversity is crucial for identifying suitable properties within one’s financial capabilities.

Common Property Types on Zillow

Single-family homes remain the most prevalent property type listed on Zillow in Dallas, followed by townhouses and condominiums. The availability of each type varies significantly across different neighborhoods, reflecting the unique character of each area. Luxury properties, including large estates and high-rise condos, are also prominently featured, particularly in affluent neighborhoods.

Properties Organized by Price Range and Type

Zillow’s search filters allow users to easily sort properties by price range and type. For example, users can search for single-family homes between $500,000 and $1,000,000 or condos under $300,000. This functionality makes it simple to find properties that align with specific budgetary constraints.

Average Price per Square Foot by Property Type and Area

The average price per square foot varies considerably depending on property type and location. Generally, single-family homes in affluent areas command significantly higher prices per square foot compared to condos in less expensive neighborhoods. For example, a single-family home in Highland Park might average $600 per square foot, while a condo in a more affordable area might average $250 per square foot.

Distribution of Property Prices

A visual representation of Dallas property prices based on Zillow data would show a skewed distribution, with a long tail extending towards higher price points. This indicates a significant concentration of properties at lower to mid-range prices, with a smaller but substantial number of luxury properties at the higher end of the market. The median price would likely be lower than the average price, reflecting the influence of those high-value properties.

Factors Affecting Home Prices in Dallas Suburbs

The Dallas suburbs present a diverse range of real estate markets, each with its unique characteristics and price dynamics. Understanding these differences is crucial for making informed decisions about where to buy or invest.

Comparison of Dallas Suburb Real Estate Markets

Suburbs like Plano, Frisco, and Irving offer different features that affect property values. Plano, known for its strong corporate presence and excellent schools, generally commands higher prices than Irving, which may have more diverse housing options and a slightly lower cost of living. Frisco, experiencing rapid growth, often sees higher prices due to increased demand and new construction.

Factors Driving Price Differences

School districts are a major factor influencing home prices in Dallas suburbs. Highly-rated school districts tend to attract families, increasing demand and driving up prices. Commute times to major employment centers also play a role, with properties closer to Dallas’s central business district typically commanding higher prices. The availability of amenities, such as parks, shopping centers, and recreational facilities, further impacts property values.

Using Zillow to Understand Price Variations

Zillow’s data allows for a detailed comparison of properties across different suburbs. By filtering searches by location and key features, users can identify properties with similar characteristics but varying prices. This helps in understanding the relative value of properties in different areas and identifying potential bargains or overvalued properties.

Examples of Properties with Similar Features but Varying Prices, Zillow dallas

For instance, a 2,500 square foot, four-bedroom home in Plano with a highly-rated school district might list for $700,000, while a similar property in Irving might list for $600,000, reflecting the differences in market demand and school district quality. Analyzing such variations using Zillow’s data helps in identifying the premium associated with specific location advantages.

Using Zillow for Investment Opportunities in Dallas

Zillow can be a valuable tool for identifying and evaluating potential investment opportunities in the Dallas real estate market. By leveraging its data and features, investors can make more informed decisions and increase their chances of success.

Identifying Investment Opportunities

Zillow’s data allows investors to screen properties based on various criteria, such as price per square foot, rental income potential, and recent sales data. By analyzing these metrics across different neighborhoods, investors can pinpoint areas with strong potential for appreciation or rental income.

Criteria for Evaluating Investment Properties

Key criteria for evaluating investment properties using Zillow include:

- Price per square foot compared to similar properties in the area

- Rental income potential based on comparable rentals

- Recent sales data to assess market trends

- Property condition and potential renovation costs

- Proximity to employment centers and amenities

Examples of Properties Suitable for Different Investment Strategies

Potential investment properties can be categorized by investment strategy:

- Flipping: A fixer-upper in a rapidly appreciating neighborhood with potential for significant value increase after renovation.

- Rental Income: A well-maintained property in a stable neighborhood with high rental demand and low vacancy rates.

- Long-term Appreciation: A property in a desirable location with strong potential for long-term price growth.

Organizing Potential Investment Properties

Potential investment properties should be organized based on criteria such as:

- Return on Investment (ROI): Projected rental income and potential appreciation against initial investment and expenses.

- Risk Assessment: Factors such as market volatility, property condition, and neighborhood stability.

Understanding the Dallas real estate market requires a multifaceted approach, and Zillow provides a powerful tool for gaining valuable insights. By leveraging Zillow’s data effectively, prospective buyers, sellers, and investors can make informed decisions, navigate the complexities of the market, and achieve their real estate goals. Whether you’re searching for your dream home or seeking lucrative investment opportunities, Zillow Dallas serves as an indispensable resource in your journey.

Helpful Answers

How accurate is Zillow’s estimated home value?

Zillow’s Zestimate is an automated valuation, not a professional appraisal. It’s a useful starting point but should not be considered the definitive value. A professional appraisal is recommended for accurate valuation.

Can I rely solely on Zillow for my home search?

While Zillow is a helpful tool, it’s crucial to work with a real estate agent. Agents provide expertise on local market conditions, negotiations, and legal aspects not fully covered by Zillow.

How often does Zillow update its data?

Zillow’s data is updated frequently, but the exact frequency varies. It’s best to check the listing details for the last updated date.

What are the limitations of using Zillow for investment analysis?

Zillow provides a broad overview but lacks detailed financial information crucial for investment decisions. Thorough due diligence, including professional inspections and financial projections, is essential.